Be ready before the bell.

Visualize and Attack

You're in control with manual override and guardrails. Semi-automated app

that executes your configured strategy at your broker. Lock in the plan

pre-market. Execute with conviction. Trade the plan without distraction.

Who it’s for: Traders who want a confirmed, pre market list and optional

night before preview—delivered to email or Slack.

What you get (every trading day):

• Pre market daily pick list (before the bell): entry / stop / target / risk A B C

• Evening preview (~6:00 pm ET): likely candidates for early planning

• Delivery: email & Slack (channel/webhook) + in app view

• Rationale & invalidation: one line reason and what would negate the setup

• Broker agnostic: you execute at your broker; no custody or auto trading

Why it matters:

• Levels are fresh at the open.

• Short list → lower noise, faster prep.

• Preview allows calm planning the night before.

What it’s not: personalized advice, a chat room, or copy trading.

Who it’s for: Traders who want day of validation and concise pre open context.

What you get (in addition to Pre Market Picks):

• Morning Setup (8:30–9:10 am ET)

o Status per pick: in range / gapped / invalidated

o Gap handling guidelines (general rules; not tailored)

o Key levels & catalysts (earnings, econ releases)

o Setup context (recent aggregate behavior; non promissory)

• Size helper (you input risk; we return neutral math)

• Weekly Playbook (Sun evening) — themes, heatmap, and levels for the week

• CSV/JSON export — for journals/spreadsheets

Why it matters:

• Fast go/no go decisions before the bell.

• Reduces guesswork on gaps and invalidations.

Who it’s for: Traders who want to operate their own strategy with configurable,

semi automated execution at their broker—with full manual override.

What it does:

• Ingests your Pre Market Picks, Evening Preview, and Morning Setup notes.

• Connects to popular brokers (and/or data providers) via official APIs.

• Listens to market data and monitors each pick.

• Executes your configured strategy when

conditions are met, using your parameters:

o Entry logic: market/limit at defined levels; optional time in force

o Stops: fixed or trailing (step or percentage); server or client side, as supported

o Targets: single or staggered profit taking; optional break even move after partial

o Position sizing: fixed size or risk based (based on your max risk per trade/day)

o Management: auto trail, scale out, cancel replace as configured

• Manual override at any time (approve, modify, pause, or close).

• Auditability: timestamped logs of signals, decisions, and orders; exportable.

• Modes:

1. Preview Only (paper/sim)

2. One Click (staged orders; you confirm)

3. Guardrails Auto (auto place within your limits; kill switch ready)

Safety & control:

• Kill switch and global pause; max daily risk and max position

count; symbol bans; trading window limits.

• Health checks for connectivity; alert on disconnects or rejected orders.

• Paper mode for rehearsal; notifications on fills, stops, and targets.

• You retain control—the app acts only within your explicit configuration.

Important:

• You remain responsible for orders and compliance with your broker’s

terms and local regulations. Availability varies by broker/region.

Evening Edge does not provide personalized advice or take custody of funds.

MEMBERSHIP HAS ITS PRIVILIAGES

Evening Edge Members Receive

A concise, evening list of next‑day trade ideas for liquid U.S. equities,

including ticker, action, entry, stop, target, and a simple risk grade.

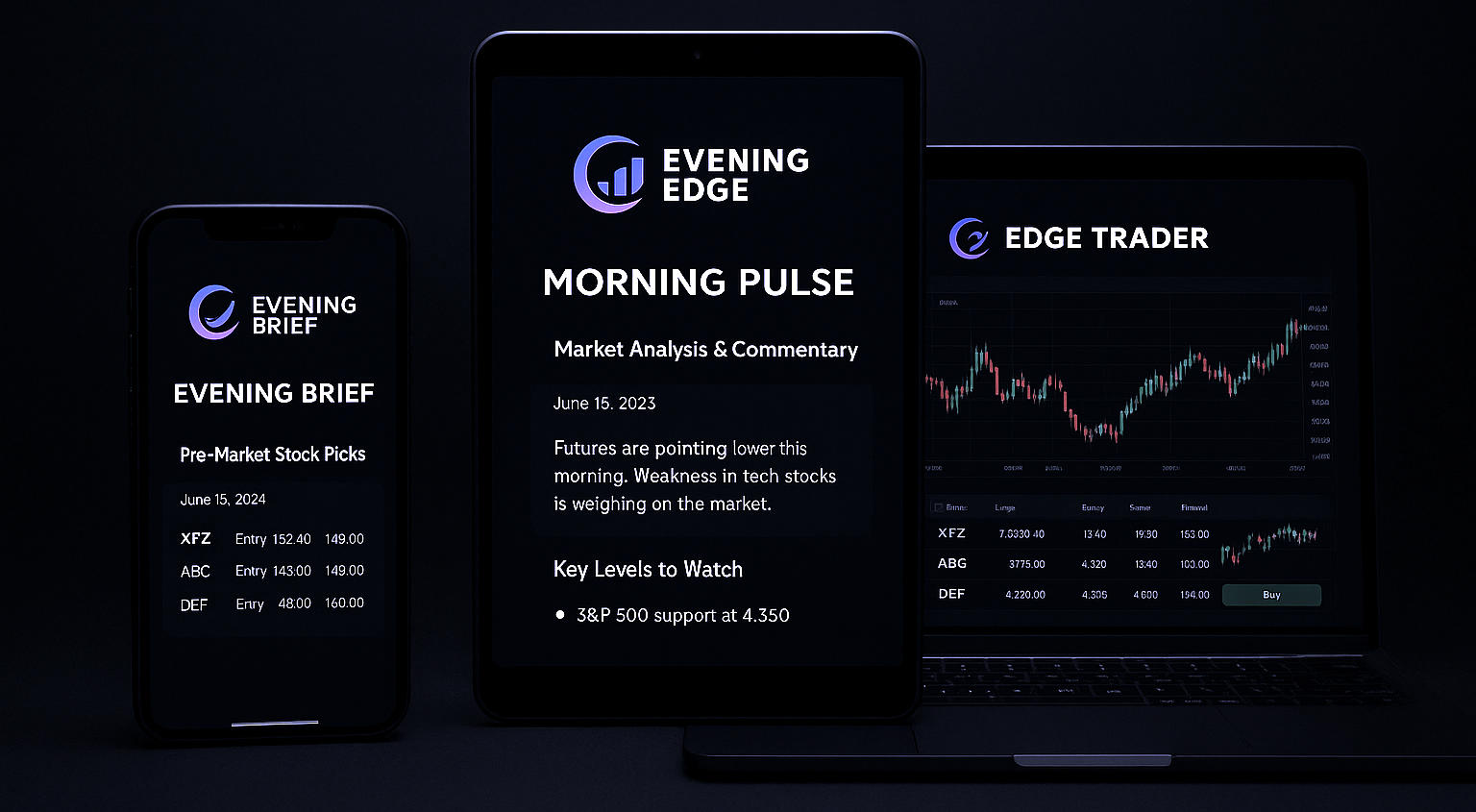

Nightly Brief

Tomorrow’s picks, tonight.

What you get

An affordable brief delivering tomorrow’s picks, key levels,

concise commentary, and a simple trading plan.

Morning Pulse

Morning game plan and nightly brief.

What you get

A 9:00 AM setup email with pick‑by‑pick notes, a broad market overview,

and last‑minute instructions.

Edge Trader

Hands‑off execution — your rules.

What you get

automated trading app that executes the picks with configurable

trailing stops, profit targets, and manual override.

PRICING

Evening Edge Membership Plans

Nightly Brief

- Daily pick list

- Concise commentary

- Key levels to Watch

- Clear game plan

- Simple trade rules

Morning Pulse

- Morning Pulse

- Opening Setups

- Broad market overview

- Last-minute guidence

- Includes Nightly Email

Edge Trader

- Auto‑trade the picks

- Configurable trailing stops

- Configurable profit targets

- Popular broker connectors

- Includes Nightly & Morning Email

Have a Question?

Evening Edge

Frequently Asked Questions

Dedicated Support

Need support ? Submit a ticket. We will be happy to assist you.

- Support Time: Monday – Friday

- Response Time: Maximum 24 hours